Unveiling the Truth Behind the Pandora Papers and Panama Papers

In recent years, two major global scandals have shaken the financial world—the Pandora Papers and the Panama Papers. While both exposed offshore leaks involving the world’s elite, they differ in scope, impact, and data sources. Let’s explore the major differences between these two significant international leaks.

The Origins of the Leaks

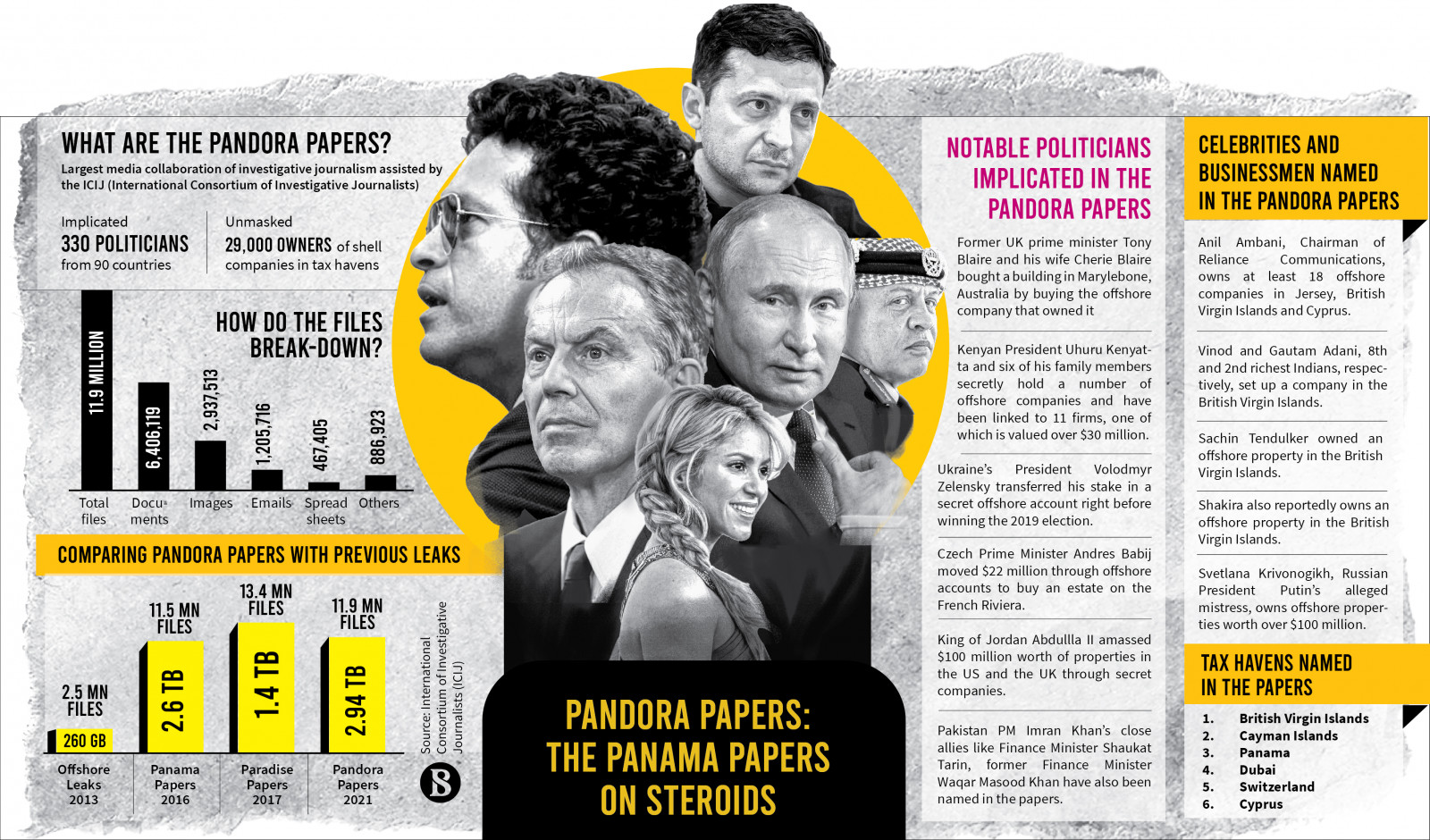

The Panama Papers leak occurred in 2016. It exposed over 11.5 million documents from Mossack Fonseca, a Panamanian law firm. These files detailed how politicians, celebrities, and billionaires used offshore tax havens to hide wealth.

In contrast, the Pandora Papers were released in 2021. They were part of an even larger leak, consisting of nearly 12 million documents. The data came from 14 offshore service firms worldwide, not just one.

Scope and Scale: Pandora Papers Leaks Outshine

The Pandora Papers leaks surpass the Panama Papers in size and diversity. While Panama Papers centered on one company, Pandora Papers covered a wide range of firms and jurisdictions. This global reach made the revelations more comprehensive and damaging.

The International Leaks Database played a significant role in organizing the data from the Pandora Papers. Its infrastructure allowed investigative journalists to collaborate across borders. As a result, the impact stretched far beyond any previous offshore leaks.

Different Players, Bigger Stakes

In the Panama Papers, many high-profile figures were named, including heads of state and business moguls. However, the Pandora Papers went a step further. It implicated 35 current and former world leaders and over 300 public officials.

The Pandora Papers also revealed the secret financial dealings of celebrities, royals, and religious leaders. This broadened the conversation from tax evasion to ethical responsibility.

How the International Leaked Documents Screening Helps

With vast data volumes, the International Leaked Documents Screening tool became essential. It streamlined the analysis of the Pandora Papers. Journalists and investigators used this screening to verify names, financial trails, and connections.

Compared to 2016, the technology and collaboration tools in 2021 were far more advanced. This allowed for faster, deeper analysis of the offshore leaks.

Global Reaction and Repercussions

The Panama Papers sparked global outrage and led to several resignations, including that of Iceland’s prime minister. Multiple investigations and policy discussions followed, but the legal outcomes were limited.

The Pandora Papers triggered wider scrutiny and calls for reforms. Many countries began using International Leaks Database Monitoring to track possible tax evasion and money laundering. The revelations renewed pressure on lawmakers to close loopholes in offshore finance systems.

Comparing Media and Public Attention

The Panama Papers were a media sensation. But the Pandora Papers, with more depth and global coverage, created a louder echo. Over 600 journalists from 117 countries worked on the investigation, coordinated by the International Consortium of Investigative Journalists (ICIJ).

This large-scale collaboration would have been impossible without tools like the International Leaks Database. It ensured consistency, accuracy, and security during reporting.

Why the Pandora Papers Matter More Today

The Pandora Papers represent a shift in how international corruption and hidden wealth are exposed. They showed that offshore financial secrecy isn’t limited to corrupt regimes. Even respected democratic leaders appeared in the documents.

By involving more countries, firms, and individuals, the Pandora Papers brought stronger attention to global financial inequality. The scale of the leaks forced governments to act, placing more emphasis on transparency and accountability.

International Leaks Database Monitoring: A Game-Changer

One key takeaway from both leaks is the need for continuous monitoring. The International Leaks Database Monitoring provides governments and financial institutions with tools to detect irregularities in cross-border money flows.

This system has become a vital part of international financial oversight. It tracks suspicious activities, reduces risks, and strengthens anti-money laundering measures.

Conclusion: Two Leaks, One Clear Message

The Panama Papers shook the world, but the Pandora Papers exposed how deep and widespread offshore secrecy truly is. With the help of the International Leaks Database and advanced screening tools, the truth surfaced on a much larger scale.

Both leaks underline the need for continued global cooperation and stronger regulations. In the battle against financial secrecy, the Pandora Papers stand as a more powerful wake-up call.

Key Takeaways:

- Pandora Papers involved more firms and data than Panama Papers.

- International Leaks Database enabled large-scale collaboration.

- International Leaked Documents Screening improved verification.

- International Leaks Database Monitoring supports real-time tracking.

- The Pandora Papers leaks triggered stronger global reactions.

These international leaks changed the way the world views offshore wealth. Their effects are still rippling through financial systems today.